Forbes Best Brands for Social Impact, Powered by HundredX

We’re proud to celebrate the brands that do well at doing good through our continued partnership with Forbes by powering the

2024 Forbes Best Brands for Social Impact list. The list spotlights 300 out of over 3,000 possible brands customers have singled out for their impact on their community, the environment, and society in general. These rankings are calculated based on more than 4 million pieces of feedback from 185,000 customers, with the ranked brands selected by consumers for their overall trustworthiness and values, support of their communities, sustainability practices, and social stances.

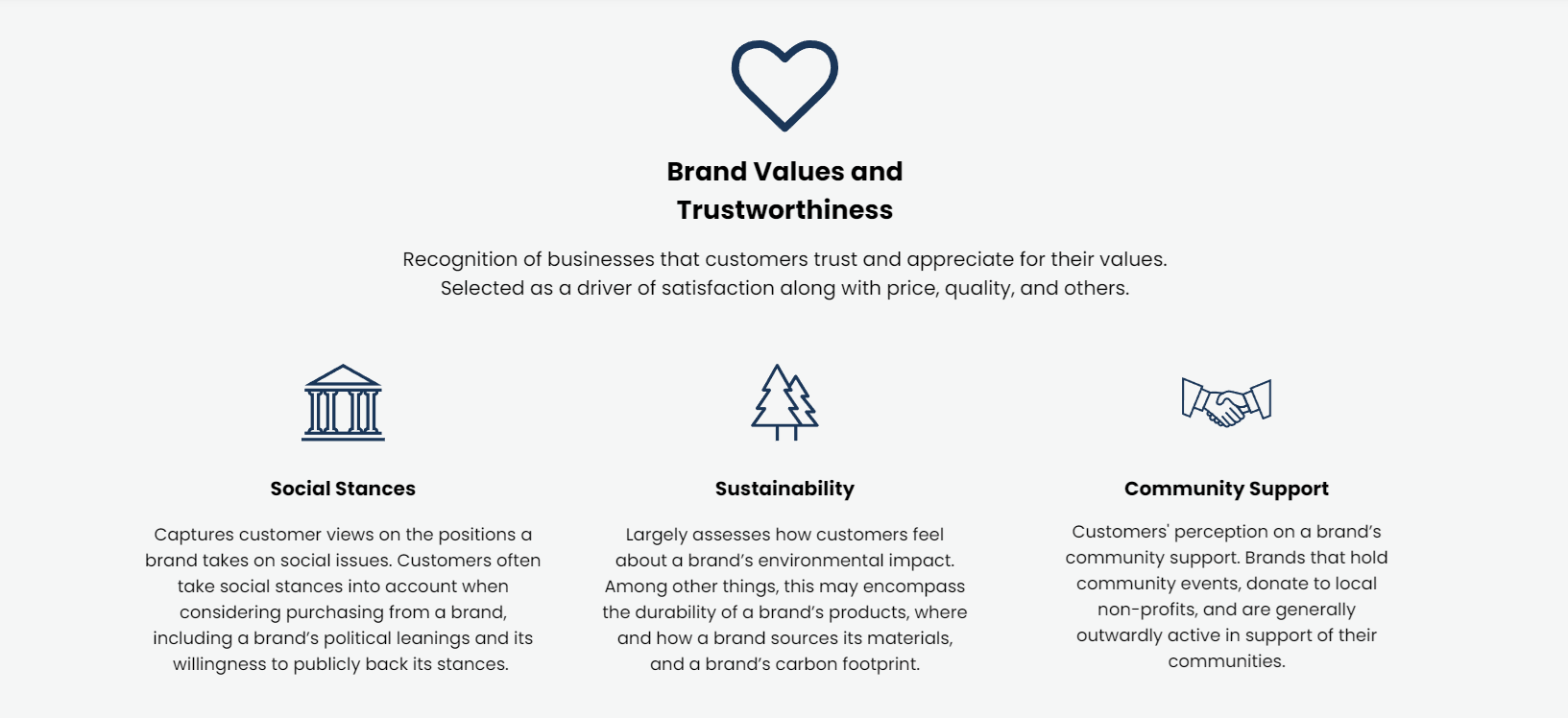

In compiling the list, we identified four critical metrics of social impact:

Sustainability is most top of mind for customers considering social impact

This year’s Social Impact rankings highlight the importance that sustainable practices play for brands. Customers leaving feedback with HundredX chose sustainability because they like or dislike a brand’s values far more than either community support or social stances. Many of the brands that rank highly in sustainability are at the top of the 2024 Best Brands for Social Impact list, including REI (#1 on the list, #1 for sustainability), Subaru (#2 on the list, #3 for sustainability), and Sony (#4 on the list, #6 in sustainability).

Discover More Information

At HundredX, we believe in the power of listening to the wisdom of “the crowd.” Our collaboration with Forbes on this list is a testament to our commitment to bringing forward insights that matter. The Forbes Best Brands for Social Impact list is a valuable guide and inspiration for businesses looking to elevate customer trustworthiness. Other Forbes lists powered by HundredX data include Forbes Customer Experience All-Stars and Forbes Best Customer Service.

We encourage businesses to reach out to us for guidance on how to join this distinguished group. With HundredX's unparalleled expertise, we can help your brand turn customer feedback into actionable strategies. This includes analyzing feedback data, identifying areas for improvement, and developing tailored solutions that drive success and customer satisfaction.

See where businesses and industries are going

*HundredX is not an investment advisor and does not provide investment advice.

All Rights Reserved | HundredX, Inc